Welcome to Lesson 4! This is a Deep Dive on understanding our current economic situation, what the options are and how you can navigate the road ahead.

It is a very valuable article and its Free for a limited time.

In the midst of Silicon Valley’s technological revolution, Sam Altman spent $35 million experimenting with Universal Basic Income.

But why would a budding tech superstar, the man behind the rise of AI and ChatGPT, spend so much time and money on such a project?

The goal was to explore potential solutions for several societal and economic issues, including income inequality, job displacement due to automation, and AI.

The experiments failed, however their very existance is the canary in the coal mine.

They are alerting us of what is to come and suggesting that there are no easy solutions. Even throwing money at people will not be enough.

And this brings us to today's topic and, that we are speed racing towards a precipice.

Even though today’s Economy appears strong, we ironically face a dire economic situation riddled with deep-seated issues.

Here is a brief overview:

Incomes: No real wage growth since the 1980s.

Affordability: Real things of value, like housing, education, and healthcare, have become unaffordable. The average home in the US is now ~$420,000.

Exploding Debts: To offset lower income and higher costs, all types of debt have soared (personal, corporate, Government)

Automation & Tech: AI and Tech will continue displacing jobs and putting downward pressure on wages.

Shifting Demographics: Americans are getting older, and there is no big young generation to take over.

Infrastructure & Cost Basis: The cost to repair old and failing infrastructure is largely prohibitive. The result is that crumbling infrastructure acts as a drag on the Economy.

Climate Change: The frequency and devastation of Natural Disasters, such as Wildfires on the West Coast, Hurricanes, and the future of Sea level rise, pose an enormous threat to our Economy. We need a way to build and fix infrastructure cheaply.

Systemic Risks: Unlike the old Economy, today, everything is intertwined and interdependent, increasing the likelihood of a Black Swan event like COVID-19 and its impact on the entire system.

For many Americans, the long-term view is not good, and perhaps this is why so many of them voted for change.

In this article, we explore the depths of our current situation and how we can potentially come out ahead.

Here is what is coming:

Part 1: Population, Credit & Growth

Part 2: Headwinds vs. Tailwinds

Part 3: Solutions

Part 4: Incomes & UBI

Part 5: Black Swan Events & Risk

Part 6: Navigating Path Forward

Conclusion

By the end of this deep dive, you should have a clear understanding of where we are currently, what to look for, and how to navigate your way forward.

Part 1: Population, Credit & Growth

In previous lessons, we established that GDP Growth = Productivity + Population + Credit. This framework helps us analyze where future growth could come from in the face of these challenges.

We need to grow ourselves out of this mess. We did this in the 1940s and 1950s. Growth paid for our huge debts incurred during WW2 raised all of our boats and improved our quality of life.

But where could such growth come from today?

Let's examine each component of our growth equation.

1) Population & Demographics

It can't come from population growth.

The US has a demographic pyramid with two massive generations that can support each other: Baby Boomers and Millennials. However, after the Millennials, the following generations get smaller and smaller.

In the 1950s, we were in a Baby Boom, and today, we are in a retirement boom. About 10,000 Baby Boomers retire every day.

This shift from highly productive members of society to retirees who collect Social Security and Medicare puts an enormous burden on the system because there are more old people collecting payments than young people paying into the programs. As a result, these programs run bigger and bigger deficits.

Currently, these two programs account for 50% of Government spending and are growing yearly.

Unlike the 1950's, the demographics here are working against us. Immigration, which has historically helped the US stave off demographic decline, faces political headwinds with the new conservative Government focused on deportations and tighter borders. This makes population-driven growth unlikely in the near term.

2) Credit: Fiscal & Monetary Challenges

We have two remaining options to get out of this mess: Productivity Growth and Credit. Using credit as a solution poses significant challenges because it requires fiscal responsibility.

Tightening the Belt

The first way is to lower spending and increase taxes. Both of these are political suicide. Raising taxes is not popular, and neither is reforming entitlements.

The US Budget Deficit is $1.9 Trillion. The budget shortfall of Social Security and Medicare accounts for a large portion of the total budget deficit. So, even cutting these programs entirely does not solve the issue. At best, we can reform these programs, but reducing payments to retirees can have many negative externalities.

What about reducing the size of the Government?

How big is the US Government anyway?

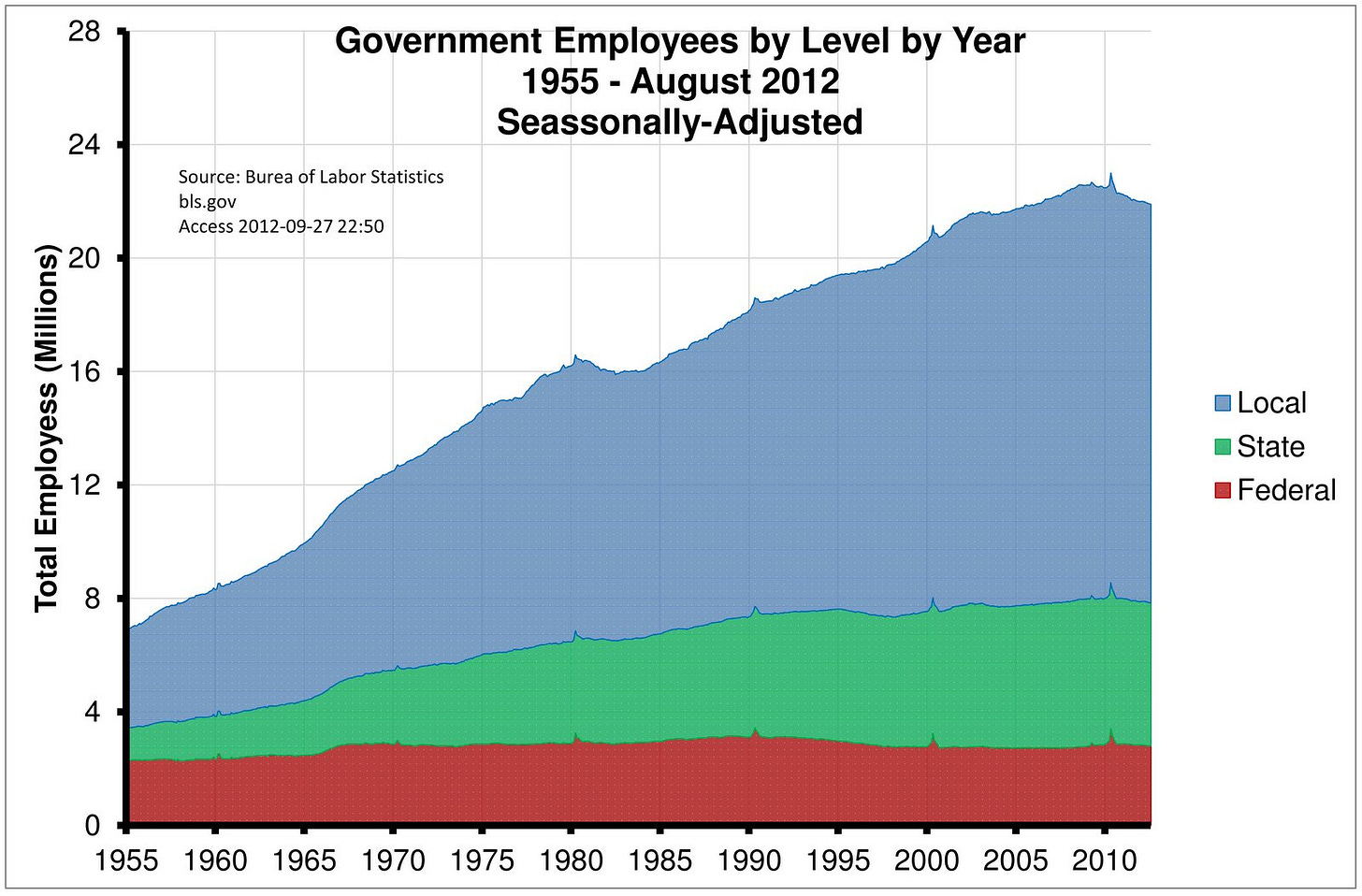

In total, there are roughly 23 million government employees, and the majority of these employees are at the local level. This includes firemen, policemen, post office workers, federal highway workers, hospital workers, etc.

The Federal Government has only 2.9 Million Employees. To put this in perspective, Walmart has 2.1 million employees worldwide.

Over the years, local governments have grown; however, the growth looks bigger than it is. When adjusted for population growth, we are actually seeing a decline in their size.

Lastly, we can look at total Government spending. US Government spending accounts for 36% of GDP. To put these numbers in context, UK Government spending is 45% of GDP, Germany is 48% of GDP, and France is 58% of GDP.

The 3% Solution

In his analysis of debt cycles, Ray Dalio proposes the "3% solution" - reducing the budget deficit to 3% of GDP. This would mean cutting the current deficit by more than half.

According to Dalio, this approach would:

Naturally, lead to lower interest rates as market confidence improves

Create room for refinancing existing debt at these lower rates

Break the death spiral of borrowing to service existing debt

Implementing this solution requires a combination of increased tax revenue and decreased spending and lower interest rates. The critical factor, Dalio emphasizes, is timing - acting quickly while the economy is strong, which provides more flexibility and requires less severe measures than waiting until a crisis forces action.

Currently, the Department of Government Efficiency (DOGE), run by Elon Musk, is looking to solve this problem.

At best, what we can expect is a mixed approach where they address each category in a meaningful way:

Major Entitlements: Social Security & Healthcare (50% of US Gov Spending)

Push out the retirement age to ~70

Update qualifications on who receives benefits

Reduce or eliminate some of the benefits for Medicare, Medicade & SS.

Discretionary Spending (50% of US Gov Spending)

Reduce the number of Federal Employees and bring in AI and Automation

Reevaluate all Government contracts and cut spending where it is excessive

No sacred cows, be willing to cut Defense

Even if they can cut as much as 30% of the total budget, it's still difficult to see how they can make up for the $1.9 Trillion Budget Deficit without getting lower interest rates and increasing revenues and growth.

For this to work, cutting around the edges wont be enough and everything needs to fall into place just right. If they thread the needle, they can begin reducing the budget deficit, which can shake up the Economy, forcing the Fed to lower rates. They can then refinance debt at lower rates and continue cutting costs while finding ways to spur growth via de-regulation and technology.

Yet, this will be a balancing act because meaningfully reducing the size of the Government via austerity will shrink the Economy, raise unemployment, and can lead to a major recession that lowers tax revenue.

Alternative Credit Approaches

As demonstrated above, taking the responsible route is a difficult balancing act that most governments fail to land. This brings us to the most common solutions.

Currency Debasement

The most common way debt problems are solved is via currency debasement. By debasing the currency, we pay off the old debt with cheaper dollars. Knowing this, the smart money will continue to borrow and buy assets and one day pay off these debts with cheaper dollars. This makes me question if higher interest rates are in the cards for longer.

Monetizing the Debt

The third way is that the Federal Reserve buys the majority of the debt. In this scenario, the debt goes on the Fed's balance sheet. The Fed collects all of the interest payments and remits all of the profits back to the US Treasury.

This approach is often referred to as "monetizing the debt" or "central bank financing of government debt." In the short term, this can lead to a significant inflection of liquidity, which lowers interest rates, drives up asset prices, and leads to inflationary pressures. In the long term, it supports zombie companies and kills growth. To a large degree this is how Japan has solved its debt problems.

» Side note: Defaulting on the debt is not an option.

So far, all of these solutions are either working around the margins or acting as a band-aid.

There is really one way forward, and that is growth.

3) Productivity: Growing our way forward

This ideal option is what the US did in the 1950s and 1960s through a huge growth boom. For such a boom, the US would need to find a way to dramatically increase its productivity, leading to a budget surplus.

Typically, leaps in productivity growth are the result of a major, revolutionary technological advancement in at least one of these areas: Energy, Transportation and Communication.

Just think of the difference between sending a letter by mail versus sending a text message. Or the difference between having and not having electricity, or what life would be like if you had to take a horse everywhere instead of your car? Odds are you won't eat out as much.

Significant advancements in these areas can change the entire paradigm of how businesses are organized and how society is arranged around them.

Here are a few thoughts on the types of technology that could be revolutionary:

Energy: Cheap renewable and nuclear energy and increased battery capacity make the following possible:

Energy for Software: Artificial Intelligence, Crypto & Blockchain, and any other businesses that require cheaper energy to become feasible, etc.

Energy for Hardware: EVs, Robots, Manufacturing, 3D printing, etc.

Transportation:

Robo-taxis and drones that transport people, goods, and services for pennies

High-Speed Rail

Communication:

AI: Deep personalization via AI agents

AR & VR that contain multiple layers of information can generate a lot of value and increase productivity

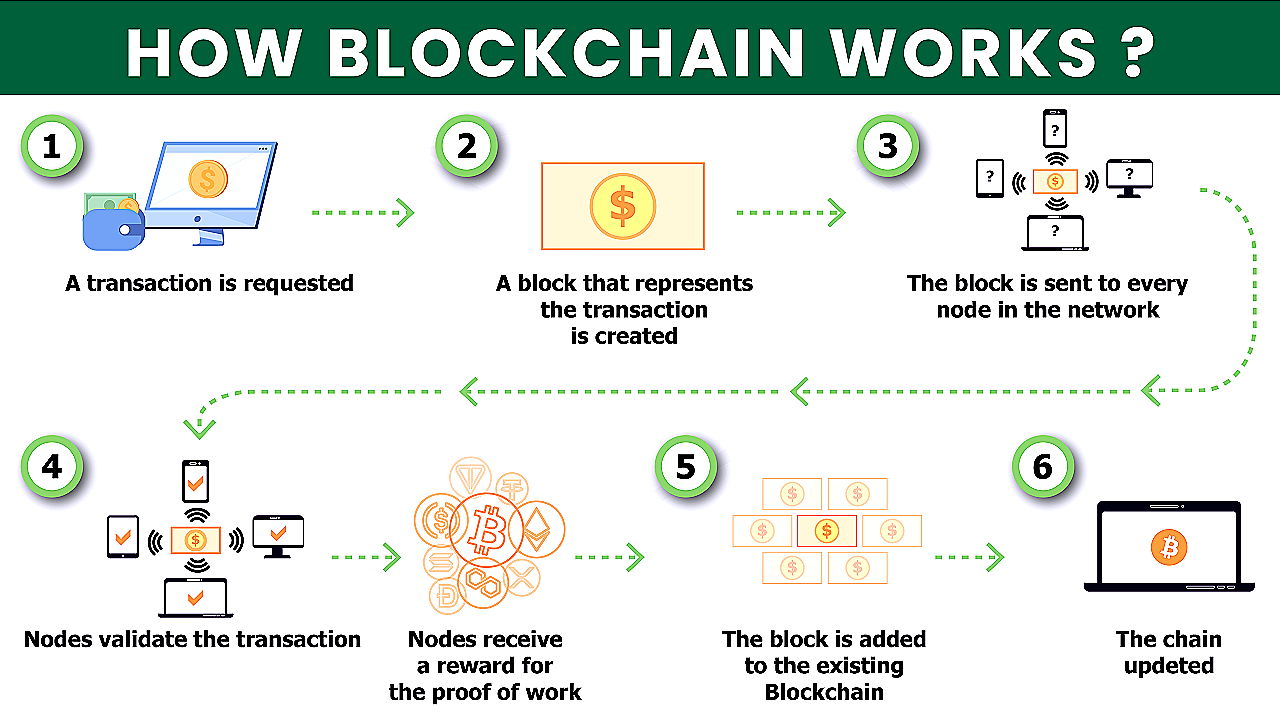

Crypto & the Blockchain, revolutionize our financial system and the ownership of assets and content on the internet

IoT, Smart Homes, etc.

Global Internet: Soon, the entire planet will have high-speed internet access via companies like SpaceX that will beam down access

Other General Purpose Technologies (GPTs)

Scientific Research: AI is enabling faster data analysis, identifying patterns in large datasets, generating new hypotheses, designing experiments, and simulating complex scenarios

Robots: Soon, we will be living like the Jetsons, with many families having their own personal Robot that does all of the house chores, runs errands, and can even babysit

Biotech: We are on the verge of numerous biotech breakthroughs, such as anti-aging drugs and gene editing, that will increase our longevity and life quality

Space: With the cost of going to space dropping by 90%, it will lead to potential advancements in scientific research, space tourism, resource extraction from asteroids, faster global logistics, and potentially even new technological innovations

Many of these technologies offer the potential to radically transform our Economy, and they are all coming at us at once.

The AI & Technology Revolution

This seems like our best hope. AI and technology are already reshaping the Economy and world. The Government is very tech accelerationist, pro-crypto, pro-AI, and pro-deregulation. We are seeing global Tech companies, like Facebook, increase their profits and market cap while decreasing headcount.

Tech contributes to growth via increased productivity; however, it is also deflationary as it can do more with fewer employees and creates a winner-take-all marketplace with many losers. In the next 5-20 years, we will also see robots that do many tasks like cooking, cleaning, chores, skilled trades, etc. This, too, will have a profound effect on our economic system.

Today, I am already using AI Agents to automate workflows. AI processes information well and applies intelligence and pattern recognition to produce predictably valuable outputs, which is very similar to what white-collar employees do. For a few hundred dollars, I can do what would have taken many thousands of dollars in employee costs, and I am not the only one.

Others like me have figured out how to leverage AI to work at scale, process information, create information, execute tasks, and develop applications, and this is just the beginning. Soon, AI will be able to transact on the Blockchain. The very notion of what a corporation is (a company is a way to organize labor towards a shared goal) loses some of its meaning and power when AI can replace much of this labor force.

In a more decent society, letting the robots do the menial work would be welcomed. However, in ours, this much creative destruction can be disorienting, confusing, and downright scary.

Nevertheless, everything has come together now, and our overall situation demands that we take advantage of this opportunity or pay the price.

Part 2: Headwinds vs. Tailwinds

Our situation is not just domestic; it extends to our place in the world and the shifting Global order.

Ray Dalio's analysis provides a useful framework for understanding our current position, identifying five major headwinds and the potential tailwinds that could offset them and how we can get to the 3% target.

Headwinds

Demographics: Aging population, fewer workers supporting more retirees

Debt: Historically high levels of Government, corporate, and personal debt

Internal Political Strife: Polarization hampering effective governance

External Political Challenges: Rising geopolitical competition

Climate Change: Increasing costs and disruptions from environmental changes

Tailwinds

AI & Robotics: Potentially transformative technologies

Scale of Innovation: Possibly bigger than the Industrial Revolution

Timing Considerations

Are we in a situation similar to the 1920s, where great innovation led to a bust?

Can we implement solutions in time to avoid crisis?

Can tailwinds address all five headwinds? Some, like demographics, don't have quick or easy solutions.

Part 3: Solutions

1) Tech Acceleration: The Growth Multiplier

Now, let's talk about how technology can solve the growth problem and what needs to happen in order to make this possible.

Remember our basic equation: Growth = Population Growth + Productivity Growth + Credit

Immigration has allowed a steady increase in the overall population and without it, the US would be in a similar situation as other Western Countries. Nevertheless, we have a large Baby Boomer generation that is retiring which means that they are leaving a gaping hole in the workforce while burdening the younger generation with higher taxes in order to pay for their entitlements.

To offset the burden and increase the number of young, talented people, that can take on these jobs, I expect a revamp of the immigration policy making it easier for highly skilled people to migrate to the US. So, paradoxically, educated immigrants will be welcomed here, will be offered high paying jobs, while the low-end cheap labor immigrant labor will be reduced leaving these jobs for Americans.

Going forward, we can safely expect that the growth will not come from a baby boom, or from massive immigration, instead the US population will continue on its current trajectory.

So what will be needed, is tremendous productivity growth from tech, so much so that it replaces the need for a big population growth.

This can come from two areas:

Artificial Intelligence

Robotics / Automation

Sometimes I reflect on how well-timed these technologies are and how fortunate we are. Artificial Intelligence, Automation, and Robotics can further drive down prices making it cheaper to take care of our Baby Boomers.

2) AI Agents

AI Agents are autonomous intelligent systems capable of achieving goals by performing tasks without human intervention. You can think of them as AI Workers. They work 24/7, and companies don't have to pay them.

AI Agents are evolving rapidly and organizations are implementing them in roles that are repetitive (e.g., customer support), require data analysis (e.g., supply chain management) and other areas such as finance, healthcare, and as personal assistants.

Soon AI will help make many White Collar workers way more productive. This will decrease the costs of doing business while improving the outcomes. In the end, we will have better and cheaper products and services.

3) Robots & Automation

Would you pay $300 per month for a Robot that did all of your house chores including cooking, cleaning, running errands, buying groceries, taking care of your pets and even baby sitting?

These Robots are approaching reality. Today you can already purchase robots like the Unitree G1 that show the direction this technology is heading.

In the next decade, robots will be everywhere, working for us in our homes, at our offices, and on our factory floors.

Each of these robots represents a massive explosion of value. They are akin to adding an almost Free Employee to the Economy. As such, Robots can have a similar impact on the Economy as an increasing population without the costs.

With this in mind, we can update our basic equation:

Growth = Population Growth (Birth Rate + Immigration + Robots) + Productivity Growth + Credit

The net effect of AI and Robots alone can help solve the problems of affordability and help us rebuild our infrastructure.

Many of the essential things of value will get cheaper in the long run:

Healthcare: AI can help bring down administrative costs, and AI Agents can make the time doctors and nurses spend with patients more productive, bringing down the cost of the entire healthcare system

Education: Tech and AI are already on the path of making sound education accessible to everyone.

Child & Adult Care: Robots that help the elderly are all but here, and not too far in the distance are AI Robots that provide child care services and education, which will be on par with going to a Montessori School.

Housing: Currently there is a housing supply shortage of about 4 million homes which has driven up the prices. In the next decade or so we will see some downward pressure in the real cost of homes as baby boomers start selling their homes, in combination with high speed internet and high speed trains making smaller towns and cities more economically viable along with cheaper Robot labor and all of this can make housing more affordable.

Smart Infrastructure: The cost of repairing old and failing infrastructure can be driven down, making it feasible for the US to take the next leap forward, 'smart infrastructure.' Here, the roads have sensors and AI chips that collect and process data and inform the vehicles on the road of what lies ahead.

Naturally, this type of technology poses a set of risks.

First, we need to be able to distinguish between AI bots and AI generated content versus humans and human generated content online.

Second, we need ways to protect our lives from being hacked. The last thing you would want is someone hacking your home, taking control of your Robot, and using your tech against you.

For both of these issues, Blockchain and Crypto offer a solution.

4) Blockchain & Crypto

Over the past few decades, we have seen many of our top institutions and companies get hacked. This includes companies like Chase, Capital One, Equifax, Target, Yahoo and even Twitter.

No centralized system is immune from getting hacked because all it takes to gain entry into their systems is a single point of failure.

This becomes especially risky for banks and financial institutions. Currently, nearly all transactions in our Economy are cleared by third-party institutions like Visa. This both adds a cost to doing business (Visa charges businesses 2-3%) and carries the baggage of systemic risk (e.g., Silicon Valley Bank).

This is where Blockchain and Cryptography come into the picture. Bitcoin, Ethereum, and other large and distributed blockchains offer security advantages because compromising them would require controlling a majority of the network.

This makes them ideal for processing transactions and storing data.

Blockchain is a peer-to-peer, 'trustless' system, which means that there is no third-party risk. There is no bank or institution to process transactions or store your money, so there is no possibility of a collapse that will take your accounts down with it.

And this technology, the Blockchain, can store all kinds of information and transactions. It can then be used in this novel way where:

It can store any content or piece of information

It can validate that a human created a piece of information/content

It gives you immutable ownership rights to your digital property

There is no 3rd party that can change the rules, take ownership away, or confiscate your digital property

It is already built on a payment gateway allowing users to buy, sell, and rent their property

Enables users to create contracts with each other that are executed programmatically

Is borderless

Has very low transaction costs

Is immutable and highly secure

In practical terms, much of the financial system will be moved over to the Blockchain, which will unlock massive opportunities and value.

We will see this in real estate, where Title and Deed of a property are on the Blockchain, taking Escrow and Title companies and their fees out of the equation as this service will be done via a smart contract.

To take this a step further, large real estate projects (e.g., Freedom Tower) will be financed by selling fractional ownership stakes via a smart contract which automatically disperses profits to the owners.Then since all of the transactions related to the project are on the Blockchain, it will become very easy to determine value and have an automatic market for the shares of the building.

In other words, a real estate project can become liquid and be traded like a stock. Eventually, we will see all Stocks, Options, Contracts, and other Derivatives on the Blockchain.

This will be a big revolution in finance as it will give everyday people the opportunity to invest in almost anything.

However, the most significant revolution will be in brands and communities.

Right now Disney's market cap is ~ $200 Billion USD and out of that their Brand is valued at about $47 Billion. The Brand value is very hard to quantify and for this reason, it is vastly undervalued. The true value of all of Disney's content, their characters, stories, and the universes they build would probably be closer to $1Trillion however, they don't have a good way to capture the full scope of their Brand Value.

Soon, this will change.

Imagine a future where you purchase Disney's Frozen, which then gives you an exclusive NFT. These collectibles reward the biggest fans by giving them access to future products, communities, and experiences, which you can sell anytime on an open market.

Loved the Movie? Next time Disney is ready to launch a Frozen sequel, it can raise funds via its fans and give them exclusive perks and even a percentage of the sales. Every time someone buys or rents the film, you earn a bit. For the creator, this unlocks tremendous value and gives fans the ability to actively contribute to a creator and gain the benefits of co-ownership when the creator makes it big.

Lastly, an economic system that's on the Blockchain would give the FED a number of precision tools that can help drive growth. Through smart contracts, they can quickly incentivize certain economic behaviors and direct the stimulus to the parts of the Economy that need it most. For example, the FED can give a special high interest rate to the people who need to save, like college students, single mothers, etc.

These are just a few examples of how AI, Robotics, and Blockchain can unleash massive growth.

In summary, AI and Blockchain can increase productivity and capture value, while Robots can increase the number of workers in the Economy, akin to population growth, and crypto can bring liquidity to markets and increase the velocity of money.

Finally, this leaves us with one massive problem: income.

Part 4: Incomes & UBI

The problem of income inequality and the fact that wages have stagnated since the late 1970s is a real issue. Believe it or not, the most significant predictor of crime is not poverty, it's income inequality; it's being poor in a rich city.

The structure of our current system makes real wage growth very difficult. Globalization, Technology, AI, Immigration, and our tax laws all put deflationary pressures on wages. Our only saving grace is the large retiring Baby Boomer generation, which is leading to job openings and labor demand.

This means that there is a small window of opportunity right now.

Over the next decade or so, we might actually see wage growth in the US.

By 2040, two of AI's most significant challenges (Energy and Manufacturing AI Chips on scale) will be solved.

This gives us a golden era of opportunity to use AI to improve our careers, grow our wealth, and put ourselves in a great position before AI fundamentally transforms the nature of work and society. More importantly, by being involved and taking responsibility, we shape how AI evolves and how we address Ethical dilemmas.

In the long term, we as a society have to figure out ways to include citizens in the growth story and give them a stake in the system. When you own a part of the system, and it rewards you, you are far more likely to protect it and look out for its interests instead of wanting to burn it to the ground.

Margaret Thatcher did something similar back in the 1980's. She eliminated the government rental subsidies and instead offered the families that were renting an opportunity to purchase their homes below market value. In this way, instead of subsidizing low income homes indefinitely, these homes were purchased by the people living there which gave them an asset that increased in price and made them richer.

In a 21st-century version of this, Americans can be incentivized and given an ownership stake in the tech revolution. This can be done by the Government directly investing in technologies like AI and crypto and owning a piece of the proceeds, which then go towards balancing the budget. Another way might be by giving US citizens a dividend that reflects the growth of the Economy and then heavily incentivizing investing that dividend.

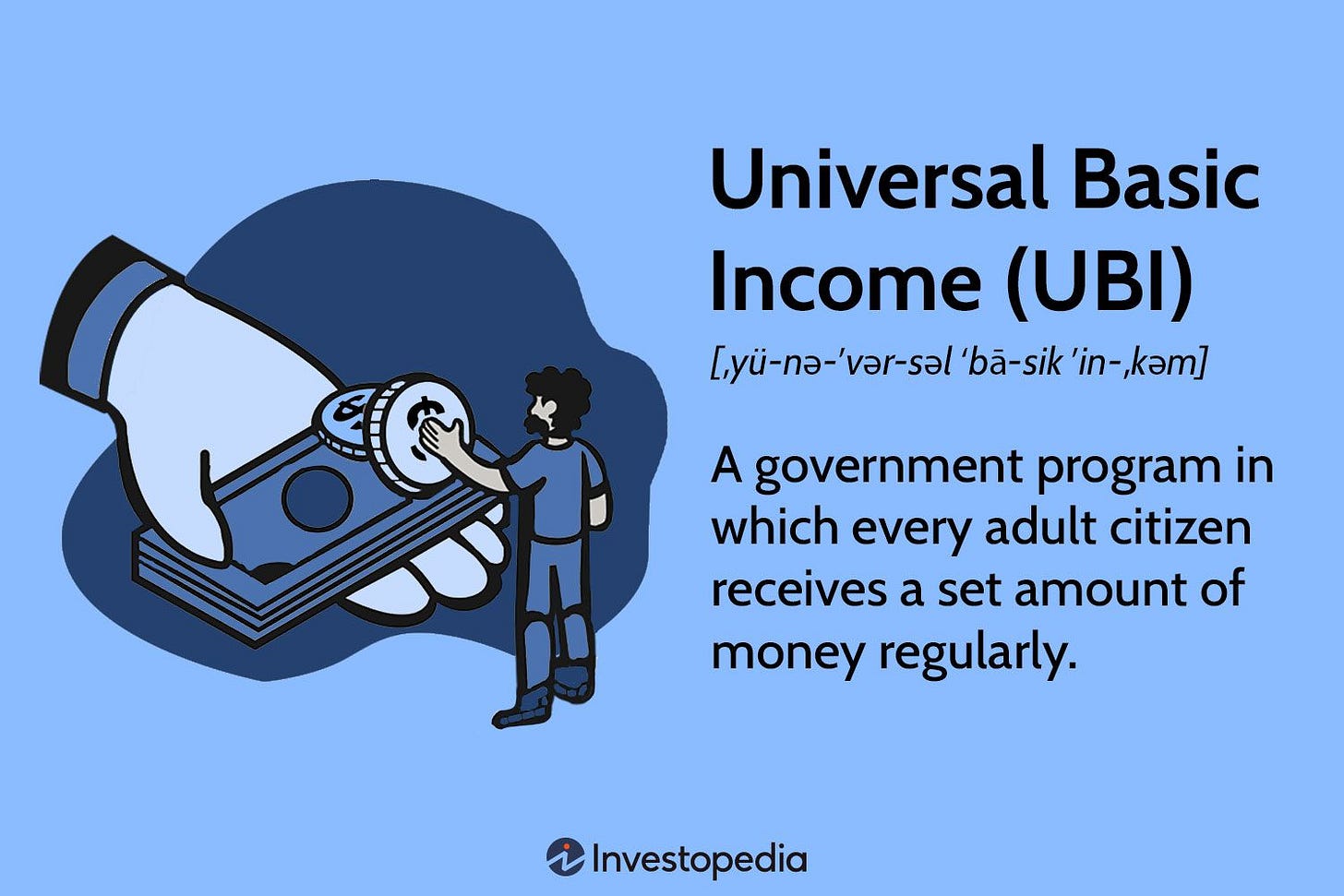

Universal Basic Income

Lastly is the topic of Universal Basic Income (UBI). This is a complicated topic that might come to the forefront as soon as the next election and will become a focus over the next two decades.

The core issue with UBI is that it fundamentally combats the meaning of money and what gives it value. Money is a medium of exchange due to people's belief in it and its scarcity.

UBI diminishes the scarcity of money, it adds more dollars to the system and then all that happens is that goods and services are repriced. A recent example of this is the inflation we are experiencing today which is, in part, a byproduct of the $5 Trillion stimulus package we received during the Pandemic.

So, if everyone in the US received $2K per month via UBI, then prices would rise proportionally.

The real solution needs to be targeted, nuanced, and fit within a personal growth framework and arc that helps people better themselves. A system that rewards you for improving, learning 'how to fish' and becoming independent, and empowering you on your path to becoming the best version of yourself.

In other words, to make Universal Basic Income work, it cannot be Universal or Basic.

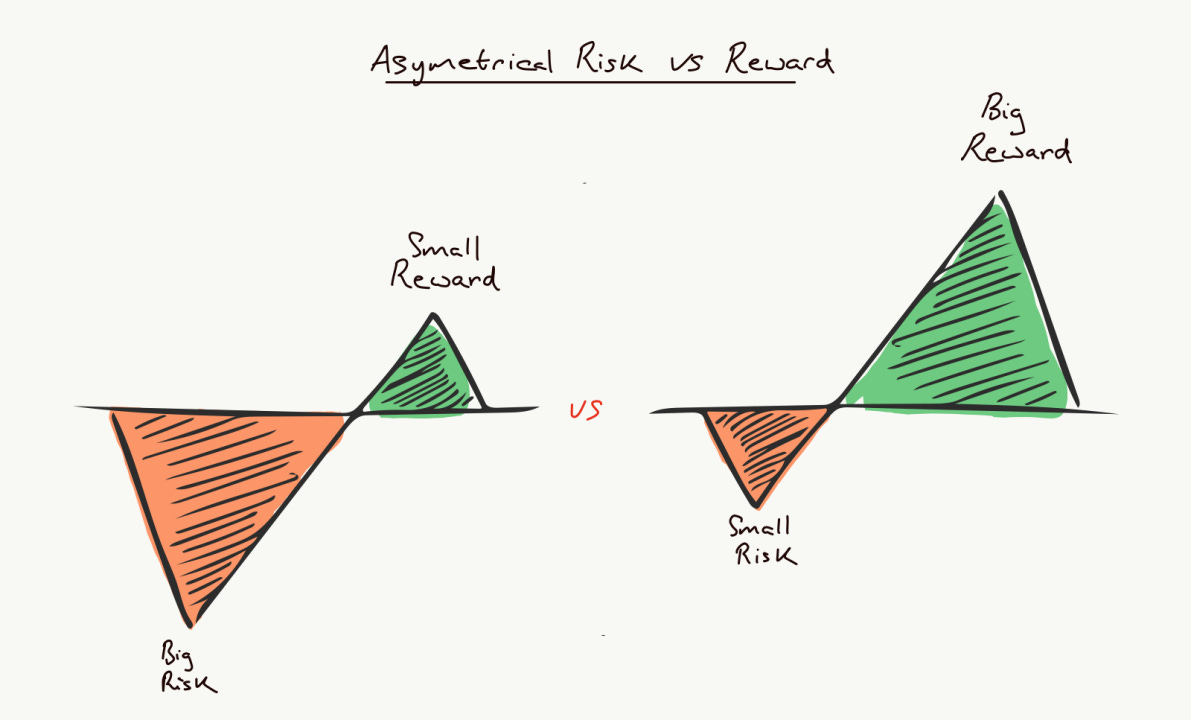

Asymmetric Rewards

With all of this in mind, I urge you to consider ways you can help the system grow and put yourself in a position to have financial freedom.

With exponential technologies, the rewards can be asymmetric. Let's look at Bitcoin, which is sold as 'Digital Gold' and compare it to Gold itself:

Bitcoin Price: $100,000 USD vs Gold Price: $2,650

Market Cap: ~ $1.95 Trillion USD vs $15 Trillion USD

Max supply: 21 Million Bitcoin vs. Gold Increases ~3% per year

Unlike Gold, Bitcoin is limited, digital, and can be easily transferred anywhere in the world in seconds. Furthermore, it has a network of 200 million wallets and 400K daily users, processes 270,000 transactions each day, and 22% of Americans own some. Lastly, it is growing 200% faster than the internet did.

Gold, Bitcoin, and Money are all founded on our shared beliefs about its value. In a world where money is freely printed, what Bitcoin represents is a pure version of 'scarcity' itself.

This leads us to the setup:

If Bitcoin fails, it goes to $0

If Bitcoin succeeds, it will reach ~$1 million in the next 5 years and surpass $3 million in the next two decades.

Asymmetric Reward: For every $1 dollar you risk, you can get back between $10 to $30

With this setup in mind, what is your affordable loss that is meaningful enough to make a difference in your life should Bitcoin succeed but meaningless should Bitcoin fail?

Part 5: Black Swan Events and Risks

The Pandemic was a Black Swan event.

Now, in complex systems like ours that have multiple wicked problems, Black Swans have become inevitable.

Why is this the case?

Because complex systems are interwoven and integrated, major failure at any one point affects the entire system.

This is like building a really high sand castle. At first, it is easy. You go higher and higher, and finally, towards the end, it only takes 1 grain of sand to bring down the entire structure.

Today, we have many grains of sand that can cause our structure to collapse.

These problems are in the domain of 'unintended consequences' and second-order effects. I will give you a few examples below to illustrate the size of the problem and then briefly share the most significant risk.

Power of unintended consequences:

Leaded Gas: At first, leaded gas was a marvel that solved the engine-knocking problem. By the time we discovered it was a neurotoxin, leaded gas had already caused us to drop 824 Million IQ points while making us more violent. It was finally entirely banned in 1996.

PFAS Chemicals: PFAS are the chemicals used in making Teflon non-stick pans, which DuPont created. DuPont created a nice business for itself worth a few billion dollars. Today, these forever chemicals are recognized as toxic, causing cancer, infertility, etc. Cleaning up PFAS would cost about $106 Trillion.

Chlorofluorocarbons (CFCs): Initially hailed as safe refrigerants and propellants, CFCs were later found to be depleting the ozone layer, leading to increased UV radiation reaching the Earth's surface.

Asbestos: Once widely used in construction for its fire-resistant properties, asbestos was later discovered to cause severe respiratory diseases, including lung cancer and mesothelioma.

As we create Exponential Technology, on the plus side we benefit from asymmetric rewards; however, the risks are also asymmetric.

Here are some of the biggest risks on the horizon:

Environmental Catastrophes: The frequency and devastation of Natural Disasters like Wildfires on the West Coast, Hurricanes, and the future of Sea level rise pose an enormous threat to our Economy and way of life.

AI & Energy: AI will require doubling, maybe tripling, the amount of electricity we create, which will put ever more pressure on our environment.

Curse of Productivity: An increase in productivity also means an increase in pollution, trash, etc.

Ecological Disaster: Currently, we are in Earth's sixth mass extinction event, also known as the Holocene or Anthropocene extinction, which is an ongoing extinction event caused by human activities.

Radicalization & AI-Enabled Terrorism: Today, viral ideas can spread at the speed of light, potentially leading people to execute more sophisticated, targeted attacks on critical infrastructure like power grids.

Part 6: Navigating the Path Forward

To move forward successfully, we need a balanced approach that addresses all growth components while managing both headwinds and tailwinds.

Now, as an individual inside a large system, it's important that you are aware of what to look for on the macro level and implement the rights strategies on the micro level. This approach can give you the best odds of success regardless of what happens.

1) Key Metrics to Monitor Directional Progress

To determine whether the Economy is moving in the right direction according to our growth framework, focus on these critical indicators:

The Dashboard Approach: Key Metrics to Track

Fiscal Health Indicators

Deficit-to-GDP Ratio: Movement toward 3% (Dalio's benchmark) indicates fiscal responsibility. This means increasing revenues and decreasing costs.

Interest Payments as % of Federal Revenue: Declining ratio shows improved debt sustainability

Bond Market Reaction to Fed Policy: Long-term rates should decline when the Fed cuts rates (not rise as we're seeing now)

Productivity Growth Signals

Labor Productivity Growth: Rising output per hour worked above 1.5% annually

Total Factor Productivity (TFP): 1-2% growth is generally healthy, and rates above 2% are often seen in rapidly growing economies.

Labor & Income Indicators

Real Wage Growth: After-inflation wage increases across income percentiles

Labor Force Participation: Rising participation rates, especially among prime-age workers

Technology Adoption Metrics

AI Integration Rate: Increasing deployment of AI across multiple sectors

Blockchain Transaction Volume: Growing usage for practical applications beyond speculation

Robot Installation Growth: Rising deployment in manufacturing, services, and other sectors

For a holistic view, track these metrics quarterly and look for patterns rather than focusing on any single data point. The most crucial consideration is directional change—are these indicators collectively improving or deteriorating over time?

A healthy Economy will show balanced improvement across these categories.

Warning signs include:

Worsening fiscal metrics without corresponding productivity gains

Productivity improvements that fail to translate to wage growth

Technology adoption that concentrates benefits rather than dispersing them

Pay particular attention to the synchronization between fiscal improvement and technology adoption. For our growth strategy to succeed, we need both fiscal responsibility (Dalio's 3% solution) and technological acceleration working in harmony.

2) Your Personal Window of Opportunity

Regardless of how our macroeconomic story unfolds, the next 5-10 years present a unique window of opportunity for individual action. Here's how to position yourself to thrive during this technological transition:

Develop Your Personal Strategy

1. Skill Positioning

AI Complementary Skills: Develop abilities AI can't easily replicate: critical thinking, emotional intelligence, meta-understanding, prioritizing what's essential, integration of complex ideas, thinking outside the box, and creativity.

Technology Management: Learn to direct, implement, and oversee AI and automation tools

Industry Positioning: Identify sectors where human expertise will remain valuable despite automation

2. Asset Allocation for Asymmetric Returns [THIS IS NOT FINANCIAL ADVICE]

Digital Asset Exposure: Consider a position in Bitcoin or other digital assets sized appropriately to your risk tolerance (affordable loss principle) [THIS IS NOT FINANCIAL ADVICE]

Technology Leaders: Consider investing in companies leading the AI/automation revolution, not just following it

Real-World Infrastructure: Consider investments in the physical infrastructure needed for technological transformation (energy, data centers, chip manufacturing)

3. Career Resilience

Multiple Income Streams: Develop 2-3 income sources to reduce dependency on any single employer

Learning Acceleration: Set aside time weekly to study emerging technologies in your field

Remote Work Capabilities: Ensure you can work effectively across geographies

4. Capitalize on AI Before It Replaces You

Personal AI Stack: Develop your own suite of AI tools that multiply your productivity

AI as Collaborator: Learn to frame problems for AI to solve while you focus on high-value work

Business Model Innovation: Consider how AI can transform your business or create new opportunities

5. Community Building

Knowledge Networks: Join communities focused on understanding technological change

Collaborative Projects: Participate in open-source initiatives or collaborative ventures

Family Preparation: Ensure those close to you know the coming changes

3) The Affordable Loss Principle

[THIS IS NOT FINANCIAL ADVICE]

When considering investments in transformative technologies like Blockchain or AI:

Ask yourself: "What amount could I lose without a significant lifestyle impact?"

Determine the minimum investment that would be meaningful if returns prove extraordinary

Diversify your transformative investments rather than concentrating in one area

View these investments as options on possible futures, not guaranteed returns

Have a plan of when you will sell and how much is enough

Remember that adaptability, flexible thinking, and equanimity are the greatest assets during times of change. While technologies themselves will evolve in unpredictable ways, the principles of learning, calculated risk-taking, and diversification remain constant.

Conclusion

The next decade presents both unprecedented challenges and unprecedented opportunities. By leveraging the explosive potential of technology while managing its disruptive effects, we can navigate through our economic challenges and build a more prosperous future.

In the following two lessons, we will talk more about:

The Exponential Age: The Age of AI Agents & Crypto

The 6-Year Plan: Managing risk and asymmetric rewards