For some time now, I have really looked forward to sharing my view of Macroeconomics and how this relates to technology and demographics.

Above is an audio version of this article and below is very deep dive, with lots of data, charts, and analysis of the forces that have shaped America and the World from 1945 to present day.

Intro to the Cycles

History may not repeat itself, but it sure does rhyme. It rhymes because demographics are destiny.

Consider how each generation comes into the world at a specific moment, faces notable challenges, and develops its own perspective on how things should work.

When that generation finally gains power, it implements solutions that make perfect sense to it based on its lived experience and what needs to be done.

These solutions work great... for a while. But then new challenges emerge, often as unintended consequences of the previous solutions. And so the cycle repeats.

To really understand this pattern, we need to look at two big pieces of the puzzle.

First, there are pure demographics—the number of people in each generation, when they enter the Workforce, get married and have children, and when they retire. This drives everything from economic growth to credit markets.

Second, we must understand how each generation's experiences shape their worldview. This includes how major events, like the Global Financial Crisis or 9/11, impacted different generations differently.

To understand how we got here, we will examine four distinct Eras and how each gave rise to the next.

1945-1973: Post-War Boom and the “Golden Age” of Capitalism

1973-1982: Stagflation and Economic Turbulence.

1982 to 2007: The Era of Globalization and Deregulation.

2007 to Present Day: The Great Recession and its Aftermath

This will give us a deep understanding of how the economic machine works, how we got to where we are today and where we are going tomorrow.

Without further ado, let's begin!

1945-1973: Post-War Boom and the “Golden Age” of Capitalism.

WW2 pulled the United States out of the Great Depression. After the war, the US became the world's dominant industrial Economy and a major exporter of manufactured goods.

Population:

Population Growth: The Baby Boom significantly increased the population.

Economic Impact: Rising consumer demand as families grew, fueling the Economy.

Cultural Developments: Traditional values dominate; emphasis is placed on conformity and stability.

Productivity Growth:

The US experienced a period of economic prosperity after the war, driven by growing consumer demand.

With European and Japanese industrial capacity largely destroyed, the US produced over 60% of the world's manufactured goods in the late 1940s.

The US invested in rebuilding countries devastated by the war, creating new markets for American goods.

American products like Coca-Cola became popular abroad, and the US promoted its culture through commercial airlines and hotels.

Credit:

1950's: Long-term mortgages and installment Credit were introduced to consumers.

1960’s: Big expansions of the Credit as Credit Cards were becoming widely used.

Government debts grew

Here is the formula for understanding GDP:

GDP Growth = Population Growth+ Productivity Growth + Credit Growth

From the 1940s to the 1960s, we had a huge pollution boom, a productivity boom, and a top export of goods and services and saw a credit boom.

As a result, GDP exploded.

The US real GDP increased by approximately 185%, nearly tripling the size of the Economy during these 28 years.

1973-1982: Stagflation and Economic Turbulence.

Imagine growing up in a quincuncial 1950s home where, on the surface, everything is perfect. You live in a well-mannered society with clear social order and codes of conduct in an ostensibly safe and homely environment.

However, there is a significant undercurrent of social anxiety and the threats of total destruction.

The threat of nuclear war hangs over this generation like a noose, and as the baby boomers reach young adulthood, many of them decide to ‘drop out.’

The threat of total destruction and the underbelly of discrimination and bigotry led to the counter-revolution and the hippie movement. All of a sudden, young people are asking questions related to sexism, racism, and war.

This has a profound effect on society, culture, and the Workforce. By the 1970’s many of the older baby boomers are off the college and the Workforce.

Population:

Baby boomers were already the largest population and are now going through many of the same life events, such as

College

Getting a Job

Getting Married

Buying Home

Raising Children

Culture & Psychology

On the surface, they were growing up in an ideal environment: a prosperous, safe, well-mannered society with clear social order and a homely atmosphere.

However, they grew up during a baby boom, meaning they had to constantly compete with their peers and put themselves first.

In their teenage years, the undercurrent of social anxiety and the threats of total destruction hung over this generation like a noose. The threats of nuclear war lead many to ‘drop out’ and focus on the pleasure of the moment. Others asked more profound questions about racism, sexism, and war.

The counter-culture and feminism lead to Women’s Rights and Civil Rights.

Many baby boomers feel smothered by rules, regulations, and high taxes, which limit their freedom and prevent many from doing what they want.

Workforce

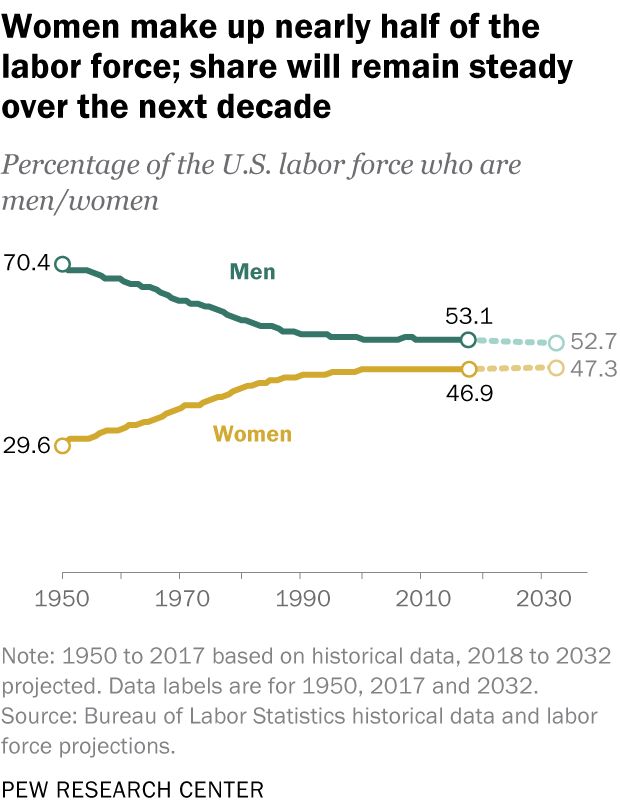

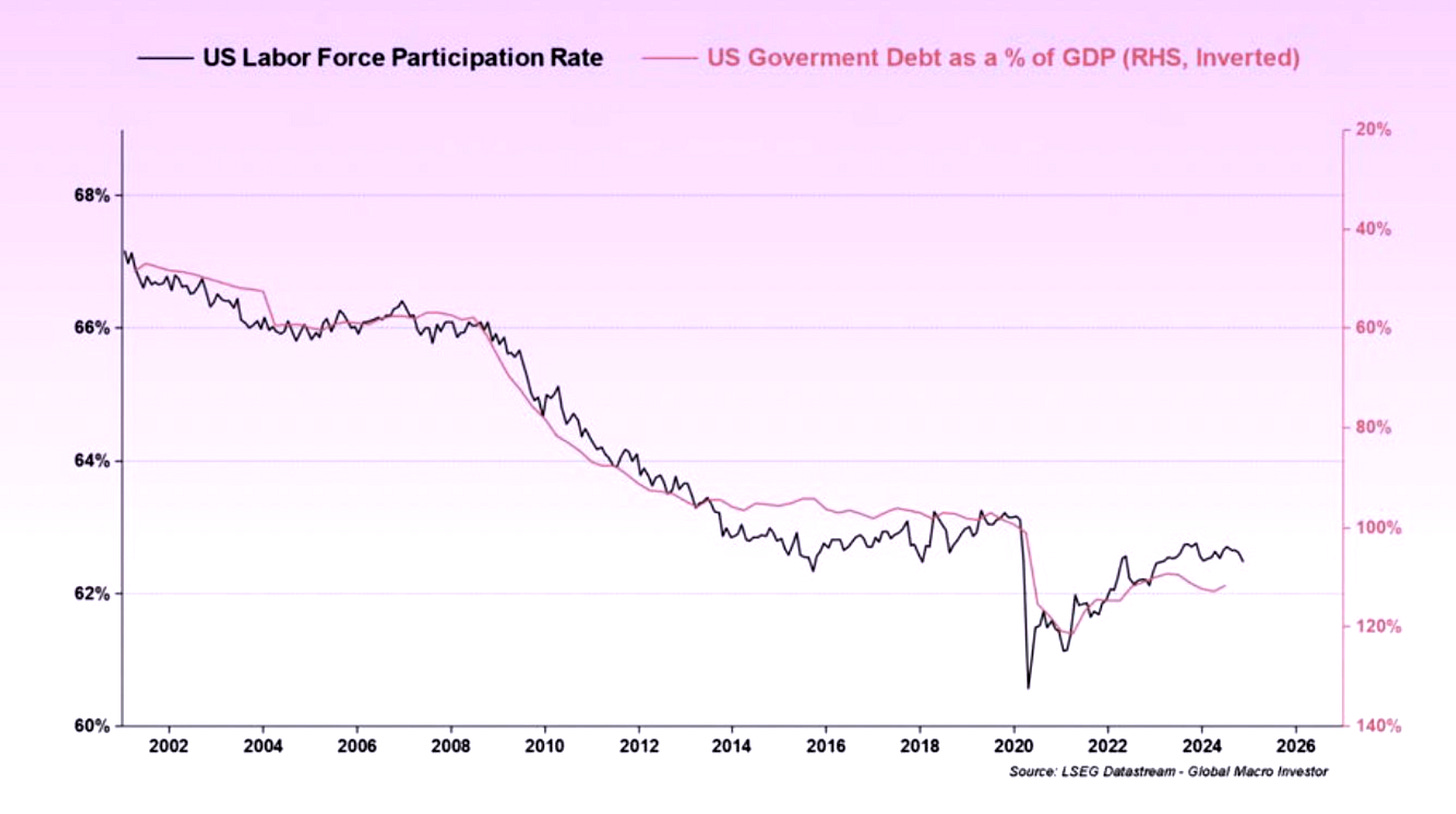

Women’s Rights and Civil Rights Movements dramatically increased the overall size of the Workforce.

More workers mean more competition for jobs, lower real wages, or higher unemployment.

More workers meant more competition for goods and services, many of which were limited by supply.

Credit:

The 1970s saw vast expansions of Credit, and both household depth and government debt grew.

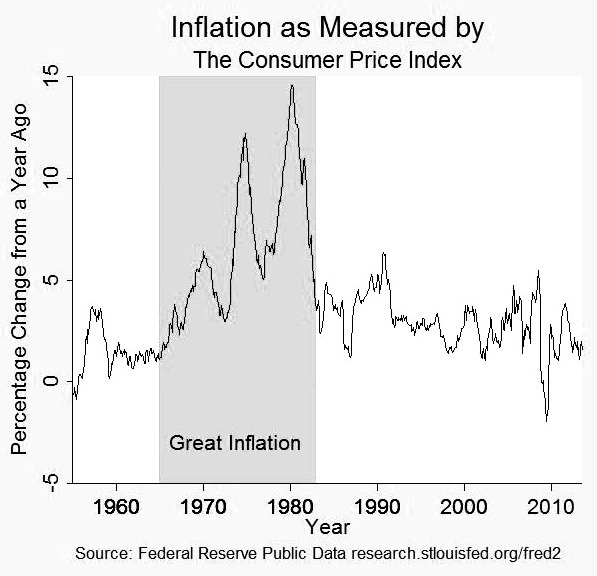

A huge population, high demand, and a giant workforce led to productivity growth and inflation in an environment where the dollar was fixed to Gold.

Global and US economic growth far outstripped the production of Gold.

The amount of Gold no longer accurately accounted for all of the value in the US economy and acted like an anchor.

» Though Experiment: Imagine if a house cost one gold bar and there were an equal number of houses and gold bars. What happens if you build 2x more houses? You create more value (houses), but since the number of gold bars is fixed, your houses are now cheaper. This can lead to significant deflation because now, one Gold bar buys you two houses. Conversely, if you exchange Gold for dollars and print 2x more dollars, it leads to inflation as it takes more dollars to buy the same amount of Gold or other goods. As a result, a Gold Standard always ends up crippling a growing economy either through deflation or inflation.

In 1971, Nixon removed the US from the Gold Standard to stop the looming gold run and the domestic inflation problem. Gold jumped from $35 per ounce to $800 in 1981.

Productivity

1960s: The 1960s saw robust productivity growth, considered part of the "golden age" of post-war economics.

1970s: Productivity growth significantly slowed down in the 1970s compared to the 1960s because

Baby Boomers Entering Workforce

The unions controlled pay rates, so pay didn’t go down; instead, prices increased.

When prices went up, Unions demanded pay increases.

This led to more inflation.

This also froze new hiring and increased unemployment.

Oil Crisis

(OPEC) began pricing oil in terms of Gold instead of dollars

During the 1973 Arab-Israeli War, OPEC imposed an embargo against the United States in retaliation for the US support of Israel.

Due to politics and the re-evaluation of the dollar, oil prices rose by about 400%.

Oil prices affect all prices because it increases the cost to produce and transport products.

By the late 1970s, the US had a full-blown economic melt-up. We were facing Stagflation, a mix of high inflation and high unemployment.

This environment had substantial knock-on effects, as banks no longer wanted to issue debt. Due to rising inflation, the dollars that repay the loan might be worth far less than the borrowed dollars. Credit systems were beginning to lock up, and liquidity was drying up.

Entrepreneurs were also in a pickle. Getting loans and starting a business was problematic. A combination of unions, high wages, high taxes, and high interest rates increased costs and reduced the benefits.

American capitalism was stuck in the mud, and something had to give.

Enter 1980’s & Reaganomics.

1982 to 2007: The Era of Globalization and Deregulation.

In 1981, Ronald Reagan was elected as the 40th President of the US, winning a sweeping victory with 489 electoral votes and the message of “Making America Great Again.”

His plan is the natural solution to the challenges of the 1970s. We needed Banks to lend, entrepreneurs to start businesses, and the American economic engine to run again.

To this end, here were some of the significant changes that came to America:

Deregulation & Free Market: Deregulation and reduced government intervention such as lifting price controls on oil and gas, easing restrictions on savings and loan institutions, and breaking up AT&T.

Free Trade & Globalization: Reducing trade barriers, tariffs, and quotas on imports promoted a global marketplace. While Globalization opened markets and reduced prices, it also led to manufacturing job losses in the US.

Weakening the Unions: Appointing officials who were less favorable to unions and promoting policies that favored management and deregulation led to a significant decrease in union memberships.

Interest Rates: After solving the issue of inflation by using very high interest rates, the Fed lowered rates to spur borrowing.

Taxes: The Reagan administration decreased the top marginal tax rate from 70% to 28%.

The end result was that Reaganomics provided a set of solutions that solved the problems the US faced in the 1970s. Inflation was defeated, banks were lending again, unions no longer had a stranglehold on businesses, regulations were eliminated, taxes were cut, and America was open for business.

Baby boomers ultimately got what they wanted: a deregulated, pro-business environment with lower taxes and more opportunities to do what they wanted.

In the 1990s, the economic policies initiated during the Reagan administration—particularly those promoting Globalization, free trade, and deregulation—were significantly expanded.

President George H.W. Bush and President Bill Clinton advanced these policies, leading to a deeper integration of the US economy with the global market.

Then, in the 2000s, George W. Bush further expanded on these neoliberal policies. Again, cutting taxes and deregulating banks led to the housing boom of the early 2000s.

Here are a few of the most impactful policies:

North American Free Trade Agreement (NAFTA): The implementation of NAFTA eliminated trade barriers between the U.S., Canada, and Mexico, boosting trade and investment but leading to job losses in US manufacturing as companies moved operations to Mexico.

Establishment of the World Trade Organization (WTO): The creation of the WTO formalized global trade rules, facilitating international trade while increasing competition for US businesses.

Financial Deregulation: The Gramm-Leach-Bliley Act repealed parts of the Glass-Steagall Act, allowing financial institutions to consolidate, which increased capital mobility and global investment opportunities.

Permanent Normal Trade Relations (PNTR) with China: Granting China PNTR status opened U.S.-China trade, enabling US companies to invest in China but also increasing imports that impacted US manufacturing sectors.

Expansion of Free Trade Agreements: The US promoted regional economic integration through agreements like APEC, encouraging businesses to expand in Asia but intensifying global competition.

Technological Advancements and the Internet Boom: Government support for technology spurred innovation and the Internet boom, enabling efficient global operations and developing international supply chains.

Reduction of Trade Barriers and Tariffs: Continued reduction of trade barriers and tariffs lowered consumer prices but increased competition, leading some US companies to relocate production overseas.

Support for Global Financial Institutions: Increased US support for institutions like the IMF and World Bank aimed to stabilize global markets and promote market-oriented reforms in developing countries.

Labor and Environmental Provisions in Trade Agreements: The inclusion of labor and environmental standards in trade agreements sought to address these issues but was often criticized as weak, raising concerns about their effectiveness.

Immigration Policies (H-1B Visa Expansion): Raising the cap on H-1B visas allowed US companies to hire more skilled foreign workers, enhancing the talent pool but sparking debates over domestic job competition.

Now let’s look at our Matrix: Population + Productivity + Credit

Population

Baby Boomers (Established Adults): Advancing in their careers, accumulating wealth, and influencing policies.

Generation X (Coming of Age): Entering the Workforce, navigating a changing economic landscape.

Millennials (Children and Adolescents): Born and growing up during this period, are influenced by technological advancements.

Population Growth: The US population grew 24% over the two decades, with millennials becoming the second largest generation.

Culture & Psychology

Economic Policies: Baby Boomers are now in leadership roles and are deregulating and globalizing the Economy.

Cultural Shifts: We see a rise in individualism, materialism, and a 'Greed is Good' mantra of the 1980s (Boomers and Gen X).

Technological Adoption: Gen X and Millennials quickly adapt to rapid technological changes.

End of Cold War: After the fall of communism and the end of the Cold War, the US embraced the idea that promoting democracy worldwide would lead to global peace and stability, so it doubled down on Globalization.

Geopolitics: The Democratic Peace Theory, which believes that democratic states never (or almost never) wage war on one another, led the US to a Geopolitical strategy that promoted the expansion of democracies.

Rise of Terrorism: The Bush doctrine was an extension of the Democratic Peace Theory, as Bush believed that spreading democracy worldwide, especially in the Middle East, would address the root causes of terrorism and lead to long-term global peace.

Productivity

Economic Transformation: The transition of the US economy from manufacturing to services between 1980 and 2007 led to significant increases in productivity as this shift involved companies moving higher up the value chain by focusing on activities that added more value per unit of input. Key drivers:

Technological advancements allowed both manufacturing and service sectors to produce more with less.

Shifting up the value chain meant focusing on high-value, knowledge-intensive activities that generated greater output per worker in the US and offshoring labor. Capital was allocated towards R&D, design, marketing, branding, and other professional services.

Globalization and Outsourcing: By moving labor-intensive manufacturing overseas, US companies reduced costs and focused domestic operations on higher-value activities.

Return on Capital Improvements: Companies directed capital toward higher-return sectors like technology and finance.

1980s: The US had modest growth influenced by recovery efforts and initial technological adoption.

1990s: Saw a significant acceleration driven by technological innovation, Globalization, and improved business practices, leading to substantial economic benefits.

2000s: Robust productivity growth averaging approximately 2.7% annually, driven by technological advancements, widespread integration of IT, Globalization, capital investment, and managerial improvements.

Disinflationary pressure.

This transition led to productivity gains in labor productivity (output per hour worked) and capital productivity (return on capital employed), contributing to economic growth and higher living standards.

Technology and Globalization substantially lowered the cost of consumer products. The low prices made the average American feel more wealthy than they were, considering that their wages stagnated.

Conversely, asset prices began to rise, and capital was rewarded more than labor for the first time.

Credit

Consumer Debt: Total consumer debt in the US grew from approximately $355 billion in 1980 to about $2.7 trillion in 2007. Interest rates dropped from a peak of 20% down to the 3% to 6% range for much of the 1990s.

Non-Financial Corporate Debt: Rose from approximately $1.2 trillion in 1980 to about $5.7 trillion in 2007.

Fiscal responsibility efforts in the 1990s and technology-led growth led to a surplus of $236 billion in 2000, yet via tax cuts and increased spending the National Debt increased from around $907 billion in 1980 to approximately $9 trillion by 2007.

The US experienced a big boom in both the Economy and asset prices. The S&P 500 Index Rose from about $110 in 1980 to over $330 by the end of 1989 and then to $1500 by 2009.

US GDP increased by by 498% from 1980 to 2007

As we can see, Reaganomics offered a good set of solutions for the challenges that the US was experiencing in the 1970s. We went from high taxes, strong unions, high unemployment, and out-of-control inflation to a new economic era that heavily favored businesses and capital, which led to a new set of systemic weaknesses.

No solution is perfect. A good solution will transform the environment so much so that a new set of problems will emerge.

Here were some of the problems that were emerging:

Labor vs. Capital: In this new environment, money and capital are becoming more valuable than labor. In other words, you can make more money by having money in the market than by working.

Wage Stagnation: Despite this boom, real wages for middle—and lower-income workers did not keep pace with productivity gains.

Net Worth: The medium's net worth increased about 155%, from $47K to $120K (in 2007 dollars); however, wages stayed flat. Even though wages remained flat, the cost of homes, health insurance, college, and retirement soared, increasing debt levels.

Retirement: Most American’s retirements are now invested in the market via 401K, Pensions, etc.

Competition & Deregulation: A highly competitive environment, meaning that it was more complex and challenging to maintain good margins, and where there was little regulation meant that businesses were heavily rewarded for taking high-risk bets. This was especially the case in the Banking Sector.

Global Financial Crisis 2007

The Global Financial Crisis was like a needle pricking a large balloon. The balloon was our Economy, and it was about to blow up.

But how did we get here?

Here is a very brief summary:

Banks created new financial instruments such as mortgage-backed securities (MBS) and adjustable-rate mortgages (ARMs).

Repealing the Glass Segal Act allowed banks to consolidate.

Banks became involved in underwriting loans, collecting fees, and selling Mortgages via MBS.

Banks were heavily incentivized to give as many loans as possible and then sell the debt, thereby getting paid twice. This was considered a ‘good thing’.

This led to a huge property boom in the early 2000s. Depending on the market, housing prices grew 10% to 25% annually, and buyers, speculators, and flippers got rich.

The Banks saw that prices were going up, so they decreased their requirements until there were none left. Eventually, anyone could buy a house or two or five, and they could even do it with no money down.

In fact, Banks were so desperate to lend that they gave borrowers loans that were 110% of the home price, used creative financing like Adjustable-Rate Mortgages, and so on. Their goal was to sell to anyone willing to sign on the dotted line, even people who could not afford it.

And then one day…

The Market Crashed.

We discovered how big the bubble was. And what we saw was a complete collapse. The balloon had been pricked, and we were in free fall:

Stock market decline: The Dow Jones Industrial Average fell by 53 percent between October 2007 and March 2009, the S&P 500 lost 38.5% in 2008, and stock wealth fell by $7.4 trillion from 2008 to 2009.

Job losses: The US lost more than 8.7 million jobs; unemployment reached 11% in October 2009.

Wealth loss: US households lost about $19 trillion in net worth, and median household wealth fell 35% between 2005 and 2011. One in four households lost 75 percent of their net worth.

Housing market decline: Home prices fell by an average of 40%, and eight million homes were foreclosed.

The system was in free fall and needed bailing out.

Why?

Because almost the entire system could have collapsed, Baby Boomers would have lost their jobs, income, and life savings. This would have wiped it all out and made retirement impossible.

With this, we see the end of an Era, the end of Reaganomics, as we face a set of problems requiring a new system.

2007 to Present Day: The Great Recession and its Aftermath

Like the 1980s, the Great Financial Crisis offered an opportunity to address the challenges of the day and the weaknesses of the economic system.

And with this massive need rose a candidate that ran on ‘Hope and Change.’

In 2008, Obama became President of the US and offered a hopeful vision of America. There was hope that Obama would reform the economic system, change how business was done, and resurrect the US economic machine.

As he entered office, the US faced significant economic headwinds, and quick decisions were needed to rescue the Economy. The biggest challenges of the moment were:

Liquidity

Bad Debt

Bad debt meant that the Banks in the US were insolvent and could no longer lend money, which froze liquidity.

To solve these issues, the Government:

$700 Billion Bailouts designed to keep troubled banks and other institutions in business

The Fed cut rates until it hit its target of 0% interest and left it there until 2015.

By and large, this solved the problems of the crisis; however, it did nothing to address the underlying foundational weakness:

Deregulation: which lead to the Global Financial Crisis

Consolidation of Power: Bank mergers made Banks too Big to Fail

Growing Income Inequality: Most families didn’t have enough savings to weather the storm.

Accountability & Perverse Incentives: No skin in the game

These weak characteristics of the new post-Reagan Economy led to the GFC and a weaker financial system. To make matters worse, many Americans felt the social contract was broken. The rich Bankers never paid a price for crashing the Economy. No one went to jail despite massive fraud. Instead, they received golden parachutes, paid for by the American taxpayer, while that same taxpayer lost their house and much of their savings.

The trust in elites, that they knew what was in America's best interest and how to navigate the Economy, was destroyed. What made matters even worse was the blatant fraud.

Here is an example:

Some banks bought insurance policies on their mortgages, even after they no longer owned the mortgages, anticipating that there would be a default and that insurance would pay out.

» Side note: This would be like a used car salesman selling you a faulty car, then buying life insurance on your family and profiting from the ensuing car crash.

After stabilizing the system, America continued with business as usual. However, the system's core foundational cracks remain unaddressed.

Instead, we doubled down and went back to the old ways, and this time, everyone knew that there was no real accountability and that, in the worst case, the Government would bail us out.

This leads to an increase in:

Stock Market & Asset Prices: A combination of low interest rates and quantitative easing leads to a massive stock market boom.

The effect of Low Interest Rates means that companies can borrow money cheaply and use that money to buy back their shares, driving up the price and their owner's net worth.

Capital over Labor: Capital now makes way more money than labor.

Taxes: The tax system rewards investors and stock owners by allowing them to compound the value of their investments annually and only pay 15% capital gains tax if or when they sell.

Wealthy stock owners never sell; instead, they borrow against their shares and pay a small interest rate.

Conversely, working for a living means paying a much higher tax rate.

Income Inequality: Investors and business elites see an explosion in their net worth.

The top 1%: This class typically consists of business owners, corporate leaders, and celebrities, and they have become uber-wealthy.

Top 10%: Professional class, engineers, doctors, SMB owners, high value add jobs, etc

Bottom 90%: blue-collar workers, laborers, low-value add jobs

Technology Disruption: Technology started having a significant impact due to its ‘winner-take-all’ feature. It brought prices down, making the founders and employees rich while hollowing out competitors.

For example, TurboTax put thousands of accountants out of business.

Business & Profitability: Most SMBs in highly competitive sectors compete on price, which leads to lower margins. The race to the bottom means that no one makes any money.

Rise of Brands & Tech: The only companies making real money are mega-brands like Louis Vuitton and Tech, which have lower costs, instant scale, and high-profit margins.

Entrepreneurs like Elon Musk, who can organize great tech teams to solve real-world problems, are massively rewarded.

Tech also has the advantage of offshoring profits and not paying income taxes.

Hollowing out of Cities: Once great industrial cities are left for dead, well-paid labor and blue-collar jobs are offshored or automated via technology.

Net Worth: Medium household net worth rose 101% from $95,471 in 2007 to $192,900 in 2024, representing a 4.21% compounded growth rate. Meanwhile, the cost of homes, health insurance, college, and retirement skyrocketed, leaving many worse off.

Increase Debt: Huge increases in debt on every level, from personal to corporate and Government.

Rise of Populism

The response to the Global Financial Crisis, the lack of accountability for institutions, and the failure to reform the Economy so that it works for the average person led to populism on both the Right and the Left.

In 2011, the Left had the Occupy Wall Street Movement, a left-wing populist movement against economic inequality, corporate greed, big finance, and money's influence in politics.

They stood for the 99% Percent and wanted the Top 1% to pay their fair share.

Does this sound familiar?

In 2016, Bernie Sanders ran on this platform. He stood with the workers, with the working class that was left behind all those decades ago. He wanted to bring them back into the fold, address the Economy's fundamental problems, and reform it so that it worked for the average American.

Fun fact: Bernie Sanders was the most prominent opponent of NAFTA and Globalization, arguing that the Government is allowing businesses to arbitrage employee salaries by making them compete with workers in Mexico and China, effectively lowering their rates.

The Right also had its populist movement. The Tea Party Movement was a small government libertarian movement led by Americans sick of bailouts and out-of-control spending.

This movement later gave rise to Donald Trump, who became President in 2016 and again in 2024.

Trump’s first win was dismissed as an anomaly, and many within the political class disregarded its significance.

In 2024, Trump won convincingly, leaving the same political class lost. Many grappled and asked, 'How could he have won?' Yet it is obvious.

Americans want change.

“It should come as no great surprise that a Democratic Party which has abandoned working class people would find that the working class has abandoned them. While the Democratic leadership defends the status quo, the American people are angry and want change. And they’re right.” Bernie Sanders

The Dawn of 'A Technology' for the People

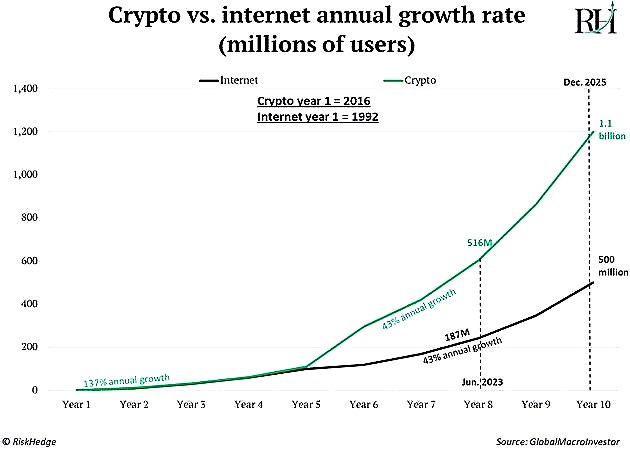

Last but not least, a technological revolution was born out of the Global Financial Crisis: Bitcoin and Crypto.

Bitcoin is a digital currency that addresses trust and stability issues by eliminating the need for corporate banks and centralized financial institutions.

It allowed anyone to transact with anyone else using a trustless system. A trustless system means that the participants involved do not need to know or trust each other or a third party for the system to function.

It solved the problem of trust using the blockchain. The blockchain is like a public ledger of all transactions, and it exists on millions of computers, which makes it secure. Through this structure, Bitcoin is transparent, anonymous, and trustworthy.

Last but not least, digital currency gives us the power and ability to do things that were previously impossible. We can now program money itself and turn currency into Software.

Fundamental Transformation of Capitalism

Since 2007, there has been an acceleration of digitizing the Economy.

Wherever there is value in using technology, technology will take the lead and fundamentally transform our Economy and society.

Just compare 2007 to 2024

Relationships

2007: People hung out in person. Dating was mediated through friend groups, work, school, etc.

2024: We spend more time online on Social Media apps than in person. We meet new people and date via apps.

Shopping:

2007: People go to Malls, Walmart, and local shops.

2024: Most people shop online via Amazon. Today, we see the death of Malls across America.

Local Businesses:

2007: Local businesses did services like tax preparation, accounting, legal, etc.

2024: The rise of Software as a Service (SAAS) has replaced entire industries.

Information

2007: We learned about the world through Newspapers, Radio, and TV. We also researched it in libraries by reading books, journals, scientific papers, etc.

2024: We learn about the world via social media apps, YouTube, and search engines, all of which use algorithms optimized to addict us. Research is done online via search engines, AI, and social media apps designed to show us personalized content that will keep us engaged.

Work

2007: Jobs were in person

2024: People, especially knowledge workers, can work from home

Part of the reason why tech has been so successful is because it fundamentally changes the rules of capitalism.

Here is what I mean:

Instant Scalability: Software can be instantly available to everyone. Compare this to a product like Coke that requires factories, transportation, sales, etc.

Lower Risk: Developing Software is much cheaper than building factories. It is iterative, easily malleable, and makes it easier to achieve product-market fit. So, it’s both cheaper to produce and easier to execute, making it far more likely to succeed.

High Margins: Since the product is digital, the profit margins are very high. For example, in 2018, Craigslist had a billion-dollar revenue and only 50 employees.

Monopoly of Mind Estate: Unlike traditional monopolies that controlled a market due to a strategic advantage, like Standard Oil, which controlled 90% of American oil refineries, today's monopolies are psychological. We use Google, which also has a 90% market share, not because there aren’t other good options, but because of Mind Estate. They have a place in our minds and habits and are the psychological default.

We are in the midst of the Fourth Industrial Revolution. We are experiencing significant changes, and technology companies are transforming the old Economy.

For example, Amazon was growing at 25% per year, and this growth is coming from somewhere. It's killed most department stores, the Mall, and almost everything in it. And this is just one example.

Let's look at our main metrics: population, Credit, and productivity, and where this leaves most Americans.

Population & Demographics

The population grew from 301 to 334 Million, representing a 12% increase over 17 years.

Net Immigration: With a declining birth rate, the modest US population growth is primarily due to immigration.

Diversity: Most immigrants come from Latin America, Asia, and the Middle East. The Hispanic/Latino population grew from 16% in 2007 to approximately 19% in 2024, while Asian Americans increased from 5.6% to 7.3%.

Aging Population

US Median Age: Increased from 37.2 years in 2007 to 40.5 years in 2024.

Baby Boomers: The generation born between 1946 and 1964 has been retiring, about 10K people per day. These retirements are decreasing the labor participation rate and tax revenue while increasing Government spending.

Culture & Psychology: How each Event Impacted the Generations differently

Global Financial Crisis

Baby Boomers: Feared that entire savings/retirement would get wiped out

Generation X: Navigating mid-career in a strained economy.

Millennials: Many graduated during the GFC and struggled with employment and student debt. The crash also scared many Millennials, who always see ‘another crash’ coming and didn't invest in the Economy.

Generation Z: Coming of age during recovery.

Covid 19

Baby Boomers: Delayed retirement plans and increased reliance on savings and healthcare resources due to prolonged economic uncertainty and healthcare needs.

Generation X: Faced job insecurity and career stagnation amid economic downturns while supporting their children and aging parents.

Millennials: Postponed key life events such as homeownership, marriage, and starting families due to financial instability and uncertainty.

Generation Z: Entered the job market during economic contractions, facing limited employment opportunities and increased competition for entry-level positions.

Generation Alpha: Experienced interruptions in early education and reduced in-person interactions, potentially affecting cognitive and social development.

4th Industrial Revolution & Rapid Change

Rapid digitalization of the Economy

Automation is taking blue-collar jobs.

Rise of AI that threatens white collar jobs

Productivity

From 2007 to 2024, the United States saw a 40.3% increase in labor productivity, averaging 1.86% annual growth.

Technological advancements, Globalization, remote work adaptations, and investments in education and infrastructure drove this growth.

Software is eating the world, and we are seeing a digitization of the Economy.

Credit

Consumer Credit:

Growth: Consumer debt increased from approximately $6.5 trillion in 2007 to around $15.5 trillion in 2024.

Components: Significant growth in credit card debt, auto loans, student loans, and mortgages.

Corporate Debt:

Expansion: Non-financial corporate debt rose from about $10 trillion in 2007 to approximately $22 trillion in 2024.

Drivers: Increased borrowing for mergers and acquisitions, share buybacks, and capital investments.

Government Debt:

Rising National Debt: The US national debt grew from $10 trillion in 2007 to over $32 trillion in 2024.

Fiscal Policies: Increased spending on stimulus packages, healthcare, defense, and social programs contributed to debt growth.

The US experienced approximately 74% real GDP Growth from 2007 to 2024, and the S&P 500 increased by 300%. At the same time, the National debt tripled, household debt nearly doubled, and corporate debt more than doubled.

The rising debt load has several significant economic impacts. It limits what the Fed can do during downturns. It also limits future growth because existing debt needs to be repaid, decreasing future spending.

In real terms, this means that many Americans make roughly the same amount of money, yet the prices for housing, food, healthcare, and education have soared. They need to save 50% more today for retirement than in 1980.

When they look at their pocketbooks, their children’s future, and the transformation of the Economy, they don’t see a way forward.

They see increased automation and job losses as technology takes their jobs. When factories return to the US, the jobs don’t come back. Instead, most of the work is now performed by robots.

And this is just the start. About 10% of the US labor force works in transportation. Self-driving cars, trucks, and AI, which can automate supply chain management, will displace many of these 16 million Americans.

In the next 18-24 months, we will see a flood of AI Agents who can perform high-cost repetitive tasks, such as cashiers, telemarketers, data entry clerks, and customer service agents. These types of jobs will start disappearing.

Many Americans see a decline in the American way of life: higher expenses, job instability, and no real way forward.

They feel like they live in a system that does not care about them, that threw them overboard 30 years ago, and one in which there is no future for them or their children.

Conclusion

So here we are in 2024, facing another set of transformative challenges. The system that solved the problems of the 1970s and 80s is showing its age, driven by massive demographic shifts, technological disruption, and the unintended consequences of previous solutions. While these challenges are significant, they're not random - they're part of a pattern we've seen before.

This brings me to my next lesson, "The Way Forward," where we'll explore what these changes mean for our future and, more importantly, what we can do about them. While the challenges we're facing are significant, they also present opportunities for those who understand what's really going on and are prepared to adapt.